Stock name: J.K. Cement Ltd.

Pattern: Double top pattern

Time frame: Daily

Observation:

Since June 2022, the stock displayed a notable upward trend, but in 2024, it stabilized, forming a double top pattern on its daily chart. A breakout from this pattern materialized on April 30, 2024. Following the breakout, the stock is descending, accompanied by a low RSI level. Technical analysis suggests that if the current momentum persists, the stock may see further downward movement.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

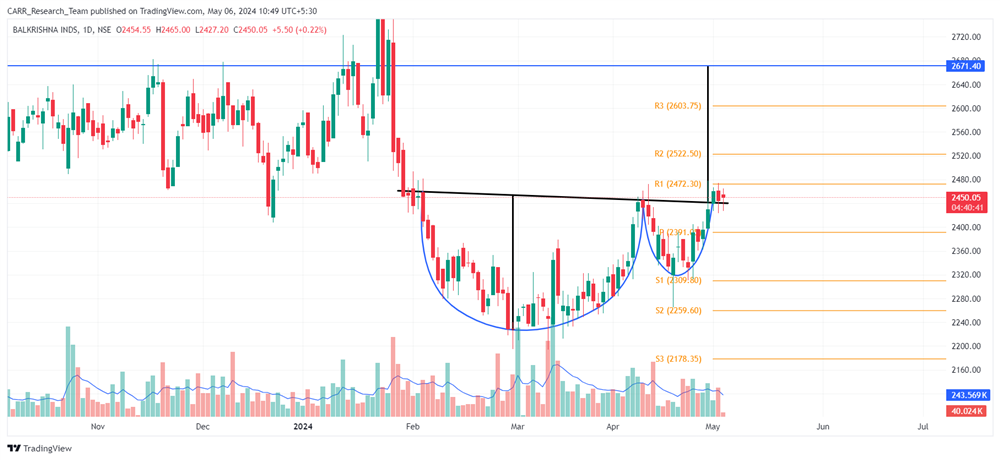

Stock name: Balkrishna Industries Ltd.

Pattern: Cup and handle pattern

Time frame: Daily

Observation:

Towards the end of January 2024, the stock experienced a downward trend, which later stabilized and formed a cup and handle pattern on its daily chart. A breakout from this pattern occurred on May 02, 2024, backed by a bullish MACD indicator. Presently, the RSI level of the stock is within a favourable range. According to technical analysis, if the breakout momentum persists, it may move further in the upward direction.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

News for the day:

- The Hinduja Group's investment arm, IIHL, aims to raise its stake in IndusInd Bank to 26%, seeking to boost its valuation to $50 billion by 2030. With RBI's nod secured, IIHL plans a significant investment of over Rs 11,500 crore for the additional stake. IIHL's broader strategy includes diversifying into various sectors, such as insurance and asset management, despite pending regulatory approvals and legal challenges.

- REC Ltd, a leading NBFC under the Ministry of Power, has obtained RBI's approval to establish a subsidiary in GIFT City, Gujarat. The subsidiary will engage in various financial activities, including lending and investment. This move reflects REC's strategy to diversify its portfolio and tap into the opportunities offered by GIFT City's growing stature as a financial hub. Vivek Kumar Dewangan, CMD of REC Ltd, expressed confidence in leveraging GIFT City's international lending platform to expand REC's presence in the global market.

- Kotak Mahindra Bank shares rose 4% post Q4 results beating expectations, despite RBI concerns and management departures. Nomura and JP Morgan upgraded the stock citing strong performance and favourable valuations. However, Jefferies and Axis Securities remain cautious due to uncertainties.